Tax Consultant Vancouver - Truths

Wiki Article

Little Known Facts About Vancouver Tax Accounting Company.

Table of ContentsFacts About Pivot Advantage Accounting And Advisory Inc. In Vancouver UncoveredWhat Does Tax Accountant In Vancouver, Bc Do?See This Report on Small Business Accountant VancouverTax Consultant Vancouver Things To Know Before You Get This

Not only will maintaining cool files and also documents aid you do your job much more effectively as well as properly, yet it will additionally send a message to your company as well as clients that they can trust you to capably handle their economic info with regard as well as integrity. Being aware of the several tasks you have on your plate, recognizing the deadline for every, and prioritizing your time as necessary will make you a significant asset to your company.

Whether you keep a detailed calendar, established routine reminders on your phone, or have a day-to-day to-do listing, remain in fee of your timetable. Bear in mind to stay flexible, nevertheless, for those urgent demands that are tossed your way. Merely reconfigure your priorities so you remain on track. Also if you choose to hide with the numbers, there's no obtaining around the reality that you will be needed to connect in a variety of methods with coworkers, managers, clients, and also market experts.

Even sending well-crafted e-mails is an important skill. If this is not your forte, it might be well worth your effort and time to get some training to raise your value to a potential company. The accountancy field is one that experiences routine modification, whether it be in policies, tax codes, software application, or ideal methods.

You'll learn critical assuming abilities to assist determine the long-term goals of an organization (and create strategies to attain them). Read on to discover what you'll be able do with an accounting level.

Some Known Questions About Cfo Company Vancouver.

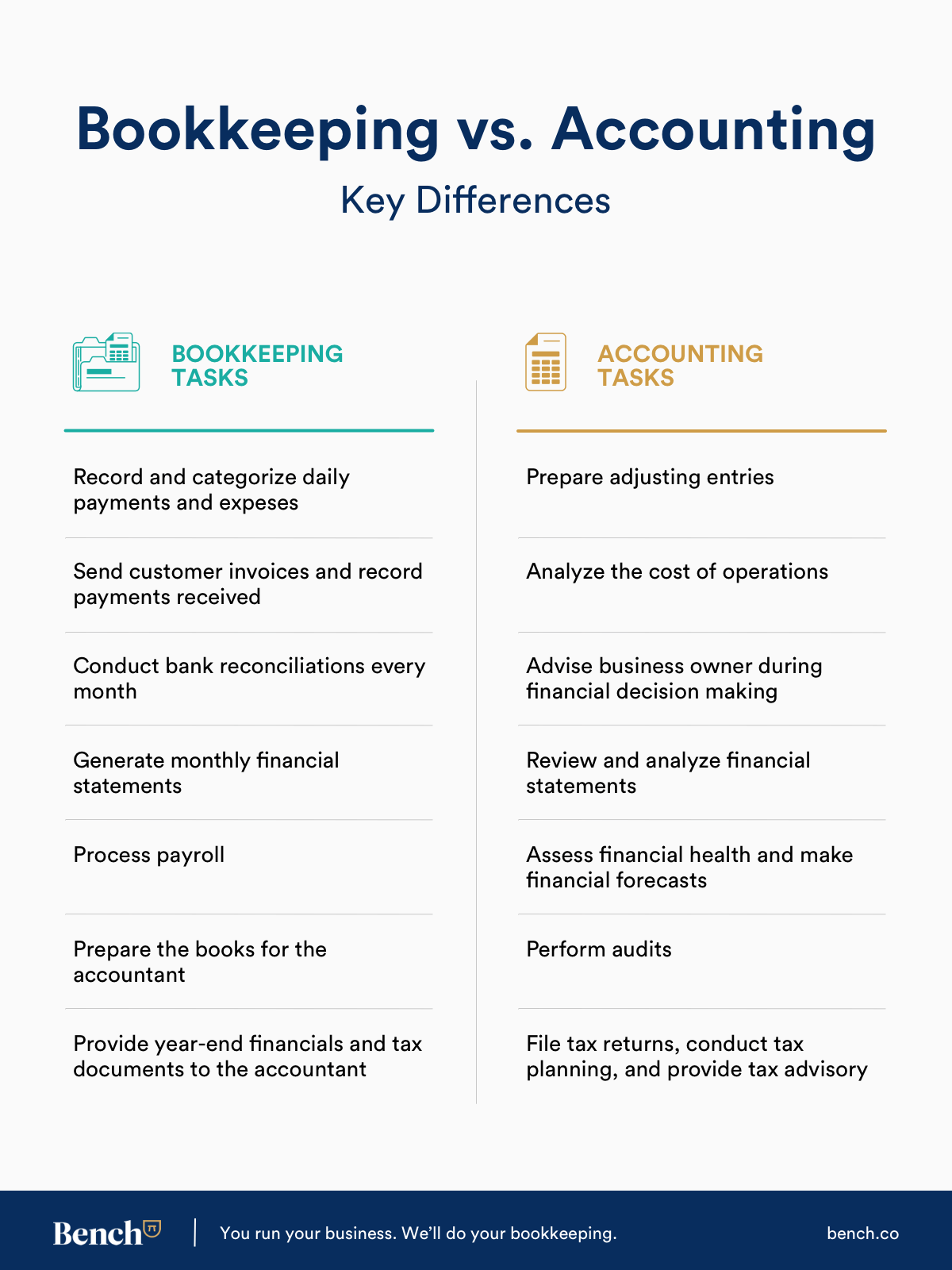

Just how much do accountants as well as accounting professionals charge for their solutions? As usual, the answer is it depends, however this article will certainly supply info on the standard per hour payment technique in addition to how we value our services below at Avalon. Just how much do accountants and also accountants bill for their services? As normal, the response is it depends, yet this short article will offer details on the typical per hour payment technique in addition to exactly how we price our services here at Avalon.To comprehend rates, it's helpful to know the difference between accounting as well as bookkeeping. These two terms are commonly utilized mutually, however there is a substantial difference in between bookkeeping as well as accounting services. We have actually created in information about, yet the extremely basic function of an accountant is to videotape the deals of an organization in a constant method.

Under the typical approach, you won't understand the amount of your expense up until the work is complete and the solution provider has actually accumulated every one of the mins invested working on your documents. This is a common rates approach, we locate a pair of things wrong with it: - It develops a scenario where customers Read Full Article feel that they shouldn't ask concerns or discover from their bookkeepers and accounting professionals because they will be on the clock as quickly as the phone is responded to.

What Does Virtual Cfo In Vancouver Mean?

Simply use the voucher code to get 25% off on check out. Plus there is a. If you're not pleased after completing the course, simply connect and we'll offer a complete reimbursement without any inquiries asked. Currently that we have actually explained why we do not like the conventional version, allow's consider exactly how we value our solutions at Avalon.:max_bytes(150000):strip_icc()/bookkeeping-101-a-beginning-tutorial-392961_final-eac0799543a04439a49f923c8b3e1717.png)

we can be readily available to assist with accounting as well as audit questions throughout the year. - we prepare your year-end economic declarations as well as income tax return (CFO company Vancouver). - we're right here to assist with questions and also advice as needed Systems arrangement and one-on-one bookkeeping training - Yearly visit the site year-end tax obligation filings - Guidance with questions as required - We see a great deal of local business that have yearly income between $200k and also $350k, that have 1 or preview for the accountant 2 staff members and are owner handled.

Solid month-to-month reporting that consists of insight from an outdoors consultant is a crucial success aspect below. - we established up your cloud audit system as well as educate you just how to submit documents online and view reports. - we cover the expense of the accountancy software application. - we record month-to-month purchases and send out helpful monetary records once each month.

Facts About Small Business Accountant Vancouver Uncovered

We're additionally offered to answer inquiries as they come up. $1,500 for accounting as well as payroll systems configuration (one-time cost)From $800 each month (consists of software application fees and year-end costs billed regular monthly) As organizations grow, there is frequently an in-between size where they are not yet large enough to have their own interior money department yet are made complex enough that just working with an accountant on Craigslist won't cut it.Report this wiki page